After two years waiting on the proverbial sidelines, Queensland first home buyers have returned to the property market, according to the Real Estate Institute of Queensland (REIQ).

Nearly 20 per cent of all owner-occupied dwellings financed in April this year were sold to first home buyers, according to figures derived from the latest data from the Australian Bureau of Statistics.

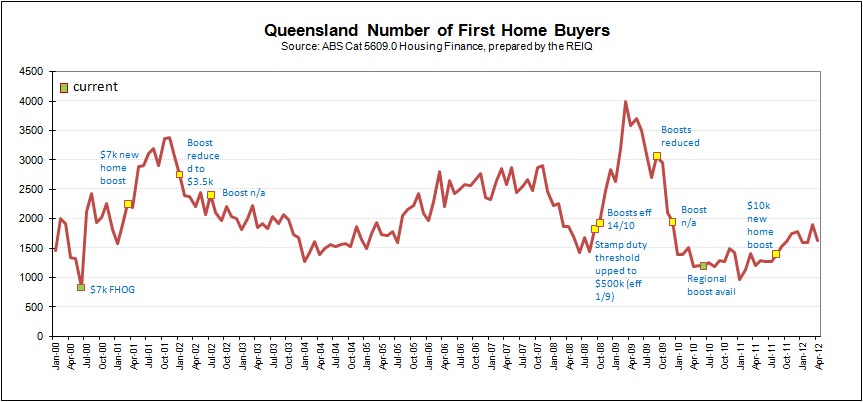

REIQ graph charting the rise and fall in numbers of QLD first home buyers over the past decade.

REIQ graph charting the rise and fall in numbers of QLD first home buyers over the past decade.

Of 8,257 properties financed in April across the state, 1,636 were purchased by first home buyers. The figures show first home buyer activity is up more than 35 per cent since the same period last year, REIQ chairman Pamela Bennett said.

In April last year, first home buyers accounted for 16.7 per cent [1,206 out of 7,236 dwellings] of all properties financed.

REIQ said investors too were making a long-awaited return to the market with more than 4,500 properties bought by investors in March this year.

The demand from first home buyers, as well as investors, has suggested the market is heading back to a more traditional buyer mix, Ms Bennett said. She said the high interest rates and the removal of the state government-funded First Home Owners Boost in 2010 had kept many first home buyers out of the market.

First home buyer activity was at its lowest following the global financial crisis in June 2010. Then, less than 1,200 properties [13.7 per cent] of about 8,600 sold across Queensland were purchased by first home buyers.

"There is little doubt that the First Home Owners Boost was a successful policy during the global financial crisis, which brought the buying decisions of many first home buyers forward, and helped to underpin our market during uncertain times," Ms Bennett said.

"It has taken a few years for underlying demand from first-timers to strengthen once again and that is what we are now starting to see in the market. Interest rates are now lower and they can also access the $7,000 First Home Owners Grant and stamp duty concessions of up to $15,000, which are all attractive propositions for first home buyers."

in Miscellaneous